The Recession is Here and is Likely to Stay

The right question that investors should ask is not whether the fiscal and monetary policy tightening will cause a recession but instead how long it will last.

The US economy is already in a recession, as defined by two consecutive negative real GDP growth prints. At least according to the Atlanta FED GDP Now forecasting model, which now estimates real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 of -2.1%. The official data from BEA showed that the US economy shrank by 1.6% in the first quarter.

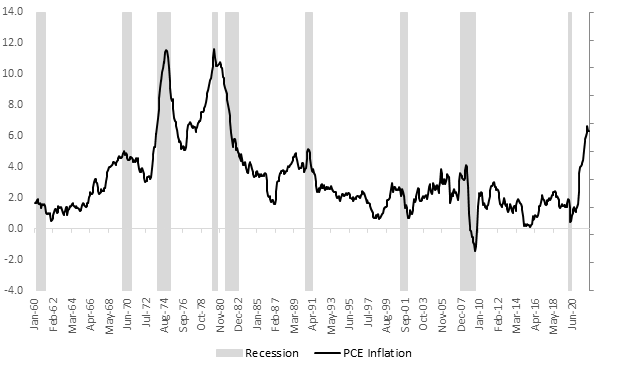

A recessionary environment means that inflation most likely reached its highest level in the second quarter since, as history suggests, almost every inflation peak has coincided with an economic recession (see the following chart). However, history also indicates that inflation decreases slowly. There are two instances since 1960 that headline inflation measured by Personal Consumption Expenditure (PCE) has exceeded the current level of 6.0%. It took 12 to 15 months to come down by 400 bps from peak levels (current headline PCE inflation needs to decline by this much to reach the FED target of 2% annually). Those periods include 12 months in the mid-1970s and 15 months from the peak level during the high inflationary period 1979-1981.

Source: Data from BEA, BLS

Inflation peaking would not be sufficient for the FED to ease. As FED chairman Jerome Powell put it at the ECB’s annual economic policy conference in Portugal in June, “the FED wants to see clear and convincing evidence that price pressures are diminishing before slowing or suspending rate increases”. Precisely what level Powell considers “convincing evidence” is unclear. A closer look at the June dot plot suggests that the majority of FED members expect PCE inflation to the range of 5.0-5.3% in 2022, and core PCE inflation to amount to 4.2-4.5% (the latest data from BEA showed PCE of 6.3% and core PCE of 4.7% in May). This means the central bank expects inflation to ease as 2022 progresses but stays elevated and above the long-term target of 2%. Hence, no policy easing soon.

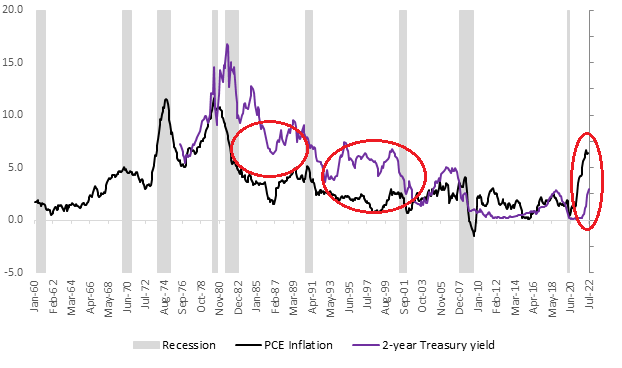

If history is any guide, the policy rate must go well above the inflation level and stay there so that the real (inflation-adjusted) fund rate turns positive. Only then would the FED kill inflation (see the following chart). In the early 1980s, the FED under Paul Volker lifted the federal fund rate well above inflation as measured by the PCE and CPI indices, causing a protracted recession. However, the subsequent experience was price stability and subdued inflation.

Source: FED, BLS, BEA

During the latest FOMC in June, FED raised its benchmark federal-funds rate by 75 bps to 1.5-1.75%, the largest in 28 years. Still, it seems that the FED is a way “behind the curve”, failing to catch up to the PCE year-over-year change (see chart above). In June, the difference between PCE inflation and the fund rate was 480 bps.

However, the monetary policy in the 1970-1980s is considerably more different than the monetary policy nowadays. Today the FED has more credibility from an explicit commitment to inflation targeting[1]. Besides, central bankers use forward guidance more, and future policy rate increases are incorporated into current financial market pricing before FED takes action. So, the best way to look at where the FED policy is likely to be in the near future is the 2-year Treasury yield. In June, the difference between the PCE inflation and the 2-year Treasury yield was around 330 bps. This is still a negative real yield.

Source: FED, BLS, BEA

Although the FED raised the benchmark rate at the fastest pace in almost 30 years, the central bank is still behind the curve. As FED is firmly committed to fighting inflation, the bank will tighten more until the market rates rise above inflation. With an economy already contracting, the result would most likely be a prolonged economic crisis. Much like the one in 1981-1982.

The inflation narrative is shifting to a recessionary one, which would be devastating for company earnings. Although there could be some short-term relief stock market rally due to the wakening inflationary pressure, the general bear market trend is likely to keep up.

[1] Is the Fed “Behind the Curve”? Two Interpretations, James Bullard

I have enjoyed your articles and look forward to many more. Your writings are well thought and no BS.

Thanks, its nice to read a unbiased and commonsense article on the economy.